How to Pay for College

In this complete guide, we'll cover the different ways students can pay for college, including scholarships, student loans, and work study.

How to Pay for College

Unfortunate though the reality may be, once your students get their acceptance letters, the excitement may be quickly tempered by the question "But how do I pay for it?"

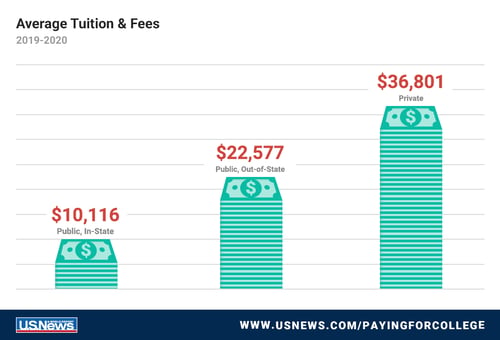

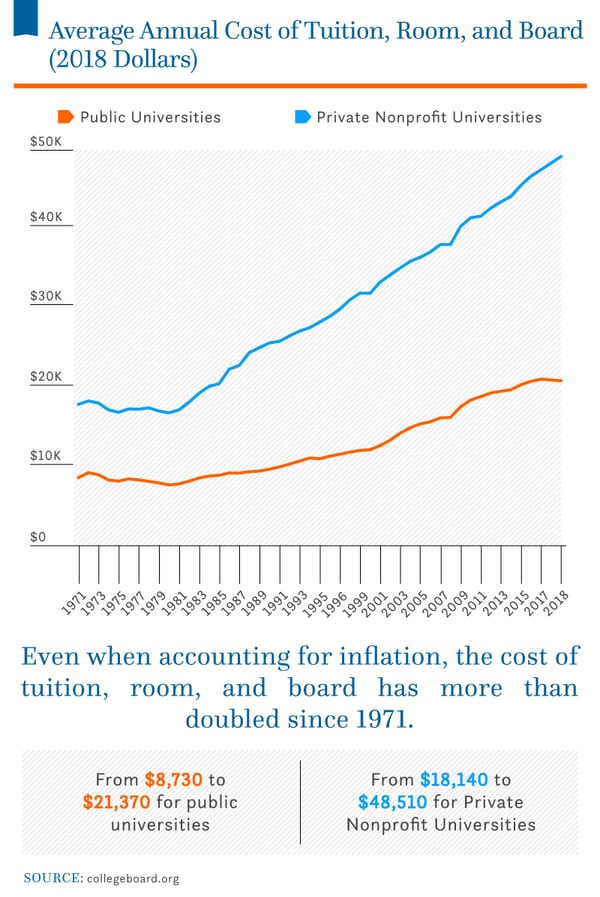

College is one of the largest expenses the majority of people encounter in their lifetime, right up there with purchasing a car or even a house. The average cost of tuition and fees in the US for the 2018–2019 school year was $35,676 at private colleges, $9,716 for state residents at public colleges and $21,629 for out-of-state students at state schools. Ivy League colleges clock in at an average of $54,414...that’s more than most students will earn in a year straight out of college, even with a shiny new college degree. Their high school summer job probably isn’t going to cut it.

If that wasn’t pricey enough, going to college costs students more than just the price of tuition. Prospective college students face four years of room and board, textbooks, personal and travel expenses, and well, you name it. College life includes all the costs of living that we pay as adults...but instead of working and getting paid, students are forking out thousands of dollars for the privilege of going to class and doing their homework.

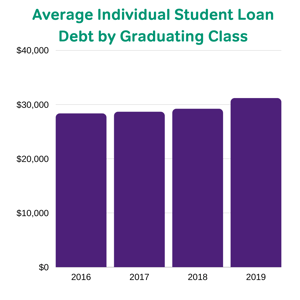

So how can a seventeen-year-old possibly pay for all this? Well, in most cases, they can’t. These days more and more American students are graduating with enormous amounts of student loan debt, often from predatory lenders who saddle students with high interest loans. Consequently, many indebted college grads will be stuck struggling just to keep up with paying off the ever-accumulating interest on those loans, and the actual loan as well. The majority of students take at least 10 years to pay off their college loans. Even former President Obama didn’t pay off his student loans until he reached age 43!

Clearly, paying for college can become a huge financial burden on students, their families, and their futures, and this can be incredibly stressful for everyone involved. College is a lot of work, and it costs a lot of money. But most students I know feel that a college degree is well worth the effort, and you can help your students circumvent the worst pitfalls if you know the right financial hacks and aid opportunities.

In this post, we’re going to take you through all the key areas you should know about when it comes to helping your students finance their college degree.

Popular Scholarship Resources:

Scholarship Search Platforms:

#1 - Fastweb

#2 - The College Board CSS Profile

#3 - Scholarships.com

#5 - Scholly

#6 - Chegg Scholarships

#7 - Niche.com

#8 - Cappex.com

#9 - Nitro Scholarship Database

#10 - Unigo Scholarship Directory

#11 - Scholarship Owl

#12 - Scholarship360

Scholarships Related to Test Scores:

#13 - The College Board Opportunity Scholarships

#14 - Scholarships.com - Scholarships by ACT score

#15 - Scholarships.com - Scholarships by SAT score

#16 - List of Top Merit-based Scholarships by College

Top Scholarship Opportunities

#17 - National Merit Scholarship

#18 - The Gates Scholarship

#19 - The Coca-Cola Scholars Program

#20 - The Dell Scholars Program

#21 - Foot Locker Scholar Athletes Program

#22 - Dr. Pepper Tuition Giveaway

College Grant Resources:

#23 - The College Grants Database

#24 - Federal Pell Grant (applied for via FAFSA form)

Scholarships & Grants

There are thousands upon thousands of scholarships out there – and they pretty much cover every topic that there is to be covered. Jif (you know, the peanut butter company) has a scholarship award for whoever makes “the most creative sandwich” … and it’s $25,000. Twenty five thousand dollars! For a good sandwich! Obviously there is money out there.

The Difference Between Scholarships and Grants

Unlike student loans, scholarships and grants are both monetary sources awarded to students to pay for college that do not need to be paid back. While scholarships are offered by all kinds of companies and organizations, grants are typically issued by the Federal and/or State government directly to colleges, which in turn share the money with students. The below list includes resources for both scholarships and grants.

Need-Based vs Merit-Based Scholarships

Some scholarships are given to students based on financial need while others are awarded on the basis of academic merit and accomplishment (e.g. GPA, extracurricular involvement). The below list includes many options for both.

Scholarships Tied to ACT and SAT Scores

Speaking of merit-based scholarships, some scholarships look closely at a student’s ACT or SAT scores when assessing their applications while others do not. We’ve included a few resources for scholarships directly tied to ACT and SAT scores below.

Scholarships For Unique Traits

There are scholarships out there offered for all kinds of unique characteristics—a student’s gender, nationality, artistic talents, athletic ability, etc. Many of the platforms listed below are organized around different traits and requirements so students can find the best, scholarships for them.

Scholarship Eligibility Requirements

Every scholarship and grant is different so students should read the eligibility requirements closely for all grants and loans. Some will require an essay, a resume, a minimum GPA, and so on.

When applying for scholarships, it’s a good idea for your student to find their niche. Many grants are highly specific. Are they an exceptionally tall student living in central Arizona? There’s a scholarship for that. Are they a Catholic student attending Loyola University in Chicago who has the last name Zolp? There’s a scholarship for that. Can they communicate with ducks? There’s a scholarship for that. I literally couldn’t make these up. Direct your students to this scholarship search engine to help them get started.

Once students have exhausted the limits of googling their identities for money, here’s a list of 5 scholarships and grants that any high school or college student can apply to:

- DoSomething.org Easy Scholarships: On DoSomething.org students can enter to win college scholarships by participating in community service campaigns--some are even as simple as sending a tweet!

- $2,000 No Essay Scholarship: Niche gives away a $2,000 scholarship every month. All students have to do is register for a free account and they are entered to win this scholarship.

- $10,000 Unigo Scholarship: Answer Unigo’s prompt in 250 words or less. One of their recent topics was “Surprise! You just got elected president. What’s your first tweet?"

- $1,000 Capex Easy Money Scholarship: Cappex provides a $1,000 scholarship every month. Students just need to create a Cappex profile and write about what they do in their free time to be eligible to win.

- $5,000 Liaison’s Data Inspired Future Scholarship: To be considered for this award, students must submit a 30 to 60 second video that discusses, explains or demonstrates an important aspect of data in today's or tomorrow's society, and includes one interesting fact about themselves!

Searching for scholarships can be exhausting, so encouraging students to schedule with their high school or college counselors can give them a leg up on the hunt.

Loans

Many college students need student loans to pay for educational expenses. However, not all loans are the same (or even worth taking).

An extremely important factor for students to look at when considering a loan is Interest rate. Interest is money paid regularly at a particular rate for the use of money lent. So when it comes to student loans, the interest rate corresponds to a percentage of the student loan that the recipient of the loan will be charged on top of the loan every year that they haven’t paid the loan off.

From 2006 to 2019, average federal student loan interest rate was 4.81%. The average amount of student loan debt last year for graduates of four-year colleges who took out loans was $28,650. So we take 28,650 and multiply it by 0.0481 to get the annual interest: 1,378. That means every year that a student doesn’t pay off their loans, the loans grow by $1,378. And then they start generating even more interest! Yikes!

The best kind of loan is obviously a zero interest rate loan, but those don’t exist in the wild--unless the student has a rich relative or other sponsor who is willing to lend them the money. This is not a viable option for most people, but it’s available, we recommend students take it!

Outside of the “wealthy benefactor loan” there are two major types of student loans: federal and private.

Federal Loans:

Federal loans are typically more affordable than private loans, and have better repayment options (as well as consolidation and even debt forgiveness) so students should definitely start with those.

Federal student loans come in two flavors: subsidized and unsubsidized. You’ll want to recommend starting with subsidized loans--that means that the government will pay the interest on the loans until your student graduates, so they don’t have that $1k+ adding up every year. There are also a type of federal loans called Parent Loans for Undergraduate Students (PLUS loans), that parents can take out to help students cover their costs, which can also be subsidized or unsubsidized.

Unfortunately, there are limits on how much federal aid someone can borrow a year, or we’d all just be taking out Federal subsidized loans until commencement day.

Private Loans

Private student loans can bridge the gap between what a student needs for school and any federal aid they receive--on top of scholarship and work-study pay (more on work-study in the next section). But students should be extremely careful when taking out this type of loan. Private loans are typically available from banks, credit unions and online lenders. Make sure they know to compare offers from multiple lenders to find the lowest interest rates available.

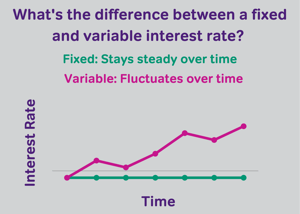

Depending on the lender, students may be able to choose a fixed or a variable interest rate. A fixed rate stays the same throughout the life of a loan. A variable rate may start out lower than a fixed rate, but could increase or decrease over time depending on economic conditions--don’t be fooled by the low starting number, and only take out the absolute minimum you need to cover expenses.

Work Study

Federal Work-Study is a program that subsidizes the paychecks of college students who work qualifying part-time jobs, typically on-campus. Students must file the Free Application for Federal Student Aid (FAFSA) to be considered for work-study (we’ll cover how to file a FAFSA in the next section).

Participants with demonstrated financial need will qualify for work-study opportunities. Those who file the FAFSA early often have a better chance of qualifying, since many schools may award aid on a first-come, first-served basis. It’s a good idea for students to file the FAFSA regardless of whether they’re interested in doing work-study, since it will connect them with other important financial aid opportunities.

.png?width=300&name=Untitled%20design%20(3).png) Even if a student becomes eligible for work study, they’ll still have to find a job (and work). If your student has been awarded work-study, but aren’t sure if they want to use it, direct them to our “Should I Do Work Study” Quiz to help them choose the best path forward.

Even if a student becomes eligible for work study, they’ll still have to find a job (and work). If your student has been awarded work-study, but aren’t sure if they want to use it, direct them to our “Should I Do Work Study” Quiz to help them choose the best path forward.

If they are interested in taking advantage of their work-study eligibility, and they know which college they’re attending, advise them to check out the college’s website or talk to a counselor about accessing the school’s work-study job database--most on-campus jobs are reserved for students in the work-study program. These roles can include working in the library or a campus office, working the phone bank to call alumni for donations, or helping with campus even setup and break down.

Completing the FAFSA

The Free Application for Federal Student Aid (FAFSA) is an online application for current and prospective US college students, which is used to determine their eligibility for financial aid. Completing the FAFSA connects college applicants with grants, federal loans, and work-study. Students can check out our “Should I Fill Out The FAFSA?” Quiz to help determine whether they’ll qualify for aid through the FAFSA.

If they do, then it’s full steam ahead:

- To fill out the FAFSA, first your students needs to get an FSA ID. Do this ASAP (it only takes about 10 minutes). Their parents should also get their own separate FSA ID.

- Start filling out the FAFSA! The FAFSA opens on October 1, and will close on June 30. Individual states and schools may have earlier deadlines, to make sure to check online...either way, your students should complete the FAFSA form as soon as possible, because much of the financial aid is first-come-first-served.

- Create a save key. Unlike the FSA ID, the save key is meant to be shared. A save key is a temporary password that allows students and parents to “pass” the FAFSA form back and forth. It also allows them to save the FAFSA form and return to it later.

- Students must enter demographics data for themselves and their parent, list the schools they want their FAFSA to be sent to, and answer the dependency status questions.

- Supply the necessary financial information. We recommend students use the IRS Data Retrieval Tool to automatically transfer their tax information into the FAFSA form.

- Sign and submit!

Tips on Reducing Expenses

The best way to cut expenses is to find less expensive things. But what this means is--before you and your students sink a million hours of unpaid labor into hunting down and applying for grants and loans--consider going straight to the source. Is there a world in which taking out $200,000 in loans to attend Rhode Island School of Design for an art degree a good idea? People do it all the time. Should your students at least know about some other options? Of course.

As you may have picked up from earlier section of this post, public schools are cheaper than private schools, especially for in-state students.

Many students are quick to dismiss the idea of community college, when they have the grades to qualify for more exclusive institutions--but the average US community college only costs $3,347 a year, and could give your students a great springboard to finish out their degree at a more expensive four-year school.

Forget cheap...some colleges are completely free! Here’s a list of schools with free tuition for all students:

- Berea College, Kentucky

- Curtis Institute of Music, Pennsylvania

- The Cooper Union, New York (currently half price, with plans to go free in the next 10 years)

- Deep Springs College, California

- Macaulay Honors College (CUNY), New York

- Webb Institute, New York

And here’s a list of schools that provide free or close-to-free tuition based on family income:

- Brown University, Rhode Island

- Columbia University, New York

- Cornell University, New York

- Duke University, North Carolina

- Harvard University, Massachusetts

- MIT, Massachusetts

- Princeton, New Jersey

- Stanford, California

- Texas A&M, Texas

- UNC Chapel Hill, North Carolina,

- Vanderbilt, Tennessee

- Yale University, Connecticut

Lastly, have your students considered studying abroad? .png?width=300&name=globe%20(1).png)

- Germany - There are no undergraduate tuition fees at most public universities, even for international students.

- France -- Public universities are open to American students for €2,770 (~US$3,100) per year for a bachelor’s degree, and the French government has recently tripled the number of scholarships available to international students from 7,000 to 21,000.

- Spain -- International students are able to study for between €750 and €2,100 (~US$845-2,370) per year at public institutions.

- Argentina -- public universities in the country are open to international students for a small fee, while private institutions can charge around US$5,000 a year.

- India -- international students will typically pay tuition fees of no higher than US$7,800 a year, and living costs in India are more than 100 times cheaper than in the United States.

If your student has their heart set on a particular (expensive) school, grants and loans can bring costs down into their price range. But if they’re not 100% sure where they want to go to college, why not choose something on the cheaper side?

Fees & Fee Waivers

As if paying for college weren’t already expensive and confusing enough, many schools require you pay a fee just to apply to them. Some schools have high fees, while others have no fees at all. The national average is $41, with the Ivies charging up to twice as much (as per usual). Wherever your students are applying, remind them to look into the application costs before pressing that submit button, so they aren’t blindsided by a huge bundle of fees.

The good news is, if your students qualify for financial assistance, they can get fee waivers. The three biggest suppliers of fee waivers are The College Board, the NACAC (National Association for College Admission Counseling, and the Common Application. Each organization has similar qualifications for waiver fees, so if your students qualify for one they’ll probably qualify for all of them.

Fee waivers are intended to be used for top-choice schools only, so each student can only receive four from each organization. However if they obtain four waivers from all three organizations, that should be enough to waive all the fees on their list! Nice hack.

As mentioned above, not all schools have application fees. In an effort to be more accessible, lots of great colleges (like Oberlin and Tulane) have done away with the fees altogether...which is a good reminder that when it comes to college applications (and colleges!) expense does not necessarily equal quality!

Financing College Visits

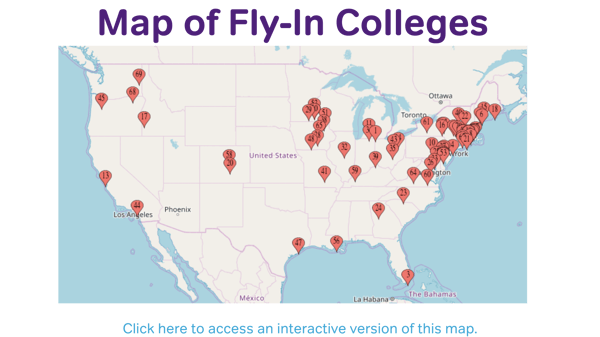

If your students are worried about the costs of college applicant visits, encourage them to consider researching College fly-in programs.

Fly-ins are visitation programs for underrepresented students, where institutions pay for transportation, room, board, and associated expenses of financially disadvantaged students, allowing them to visit their campuses for two or three days. More than 70 colleges as of this writing offer fly-in programs, though they are typically restricted to students who have been admitted to the school.

A Final Word on Paying for College

Making big decisions about the future can be exciting for your students, but also very stressful--especially if those decisions involve large sums of money.

Fortunately there are a lot of resources out there to help them safely navigate the financial minefield standing between them and their degree. With you in their corner, there’s no reason they can’t make it to college and out the other side without a mountain of debt.

.png?width=300&height=68&name=Magoosh-logo-purple-300x68%20(1).png)